Research on the Impact of Fintech on Customer Satisfaction in Gurgaon’s Banking Sector

DOI:

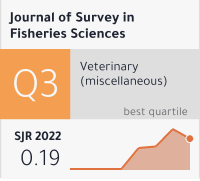

https://doi.org/10.53555/sfs.v8i3.2442Keywords:

Financial Technology, Customer Satisfaction, E banking, Customer RequirementsAbstract

The global economy has evolved into a dynamic, digital landscape, characterized by globalization, digitalization, government reforms, and heightened competition. In this context, businesses are compelled to reassess their strategies, policies, products, and services. Technology has played a pivotal role in revolutionizing economies worldwide, bridging existing gaps among developed, developing, and under-developed nations. Among sectors, banking stands out as a key provider of financial assistance and services to various industries. Given the centrality of customer satisfaction in market dynamics, banks must continually innovate their business models to enhance and sustain customer satisfaction levels. FinTech emerges as a crucial enabler in this pursuit. This study aims to analyze the role of FinTech and its impact on customer satisfaction within the banking sector of Pune city. Through a structured questionnaire administered to 100 respondents in Pune, employing non-probabilistic convenient sampling, this research explores the socio-demographic profile of participants and assesses their satisfaction levels with banking services. Utilizing frequency distribution analysis, the study sheds light on the significance of FinTech in fostering sustainable business growth within the Indian banking landscape.